Visa is partnering with a host of financial service and payment companies for a new interoperable peer-to-peer (P2P) payment offering, one that allows people to transfer money to friends even if they use a different payment service.

While digital payments have inarguably transformed the world of commerce, the sheer number of payment apps out there has hindered people’s ability to send money to other people without a little friction. If they’re both using PayPal, things work well. But if they’re not, then they either have to do a bank transfer or juggle multiple different P2P payment apps.

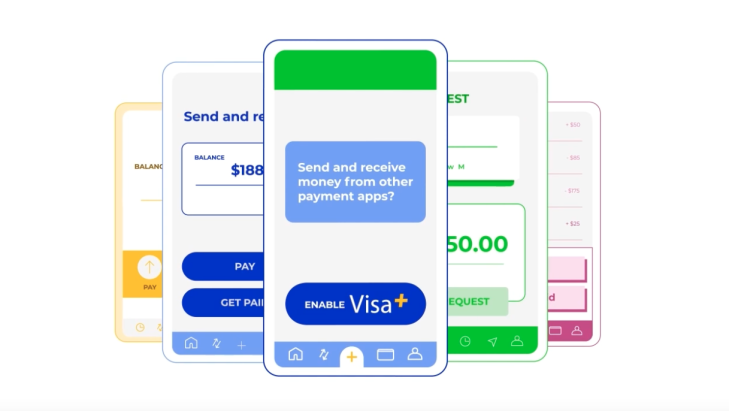

Visa+, as Visa’s new service is called, is designed to solve that problem. Later this year, Visa+ will power a new integration allowing Venmo and PayPal users in the U.S. to transfer money between the two platforms. It’s worth noting that while PayPal does in fact own Venmo already via its former parent eBay’s $800 million Braintree acquisition a decade ago, it has hitherto not been possible to transfer money in real-time between the two services.

With Visa+ activated, neither user in a PayPal / Venmo transaction will be required to have a Visa card associated with their respective accounts. Visa merely serves as the infrastructure and connecting glue between the two services — the user sets up their own unique payment handle that’s linked to their PayPal or Venmo account, and then shares that handle with whoever they want to be paid by. This means nobody has to share mobile phone numbers, email addresses, or other personal details, which may prove particularly useful for one-off payments between people who are unlikely to interact again in the future.

Other companies that have committed to Visa+ for today’s announcement include Western Union, TabaPay, i2C, and DailyPay, which Visa says will go some way toward extending Visa+ to myriad use-cases including the gig and creator economies, as well as online marketplaces.

There are, of course, a swath of high-profile omissions from Visa’s initial roster of partners, including the likes of Cash App and major digital wallet providers such as Google and Apple. However, interoperability is emerging as a key bone of contention across the digital landscape including payments, with the Linux Foundation recently launching the Open Wallet Foundation to support interoperability between digital wallets. Visa+ fits into that broader push, albeit with limited scope in its initial guise — but Visa will likely be pushing for more third-parties to join ahead of its rollout.