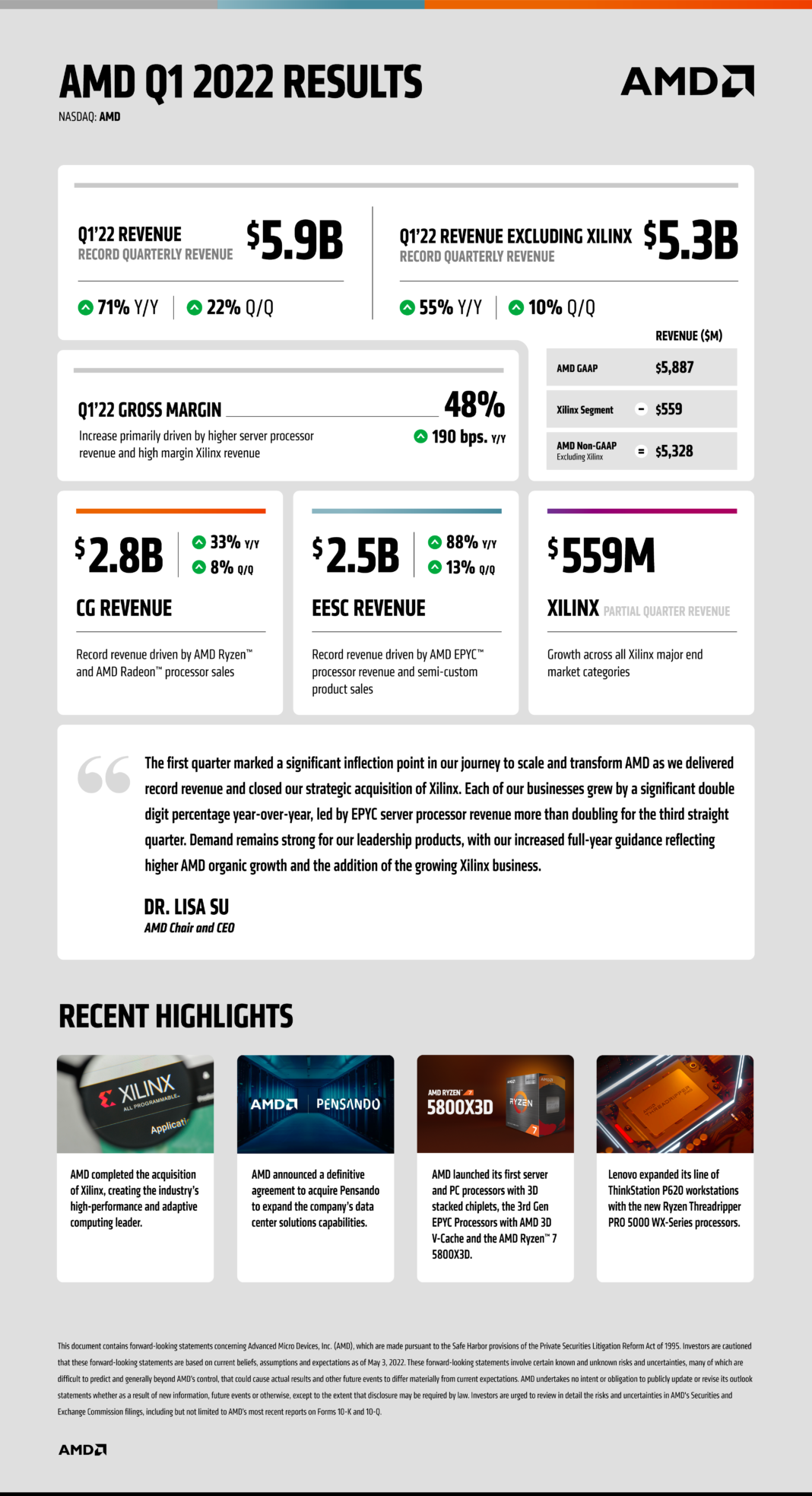

Record quarterly revenue of $5.9 billion grew 71% year-over-year; Gross margin grew 2 percentage points and non-GAAP gross margin grew 7 percentage points year-over-year

AMD (NASDAQ:AMD) today announced revenue for the first quarter of 2022 of $5.9 billion, gross margin of 48%, operating income of $951 million, operating margin of 16%, net income of $786 million and diluted earnings per share of $0.56. On a non-GAAP(*) basis, gross margin was 53%, operating income was $1.8 billion, net income was $1.6 billion and diluted earnings per share was $1.13. First quarter 2022 results include partial quarter financial results from the recently completed acquisition of Xilinx which closed February 14, 2022.

Excluding Xilinx, AMD had record quarterly revenue of $5.3 billion, non-GAAP gross margin of 51% and non-GAAP operating margin of 30%.

“The first quarter marked a significant inflection point in our journey to scale and transform AMD as we delivered record revenue and closed our strategic acquisition of Xilinx,” said AMD Chair and CEO Dr. Lisa Su. “Each of our businesses grew by a significant double digit percentage year-over-year, led by EPYC server processor revenue more than doubling for the third straight quarter. Demand remains strong for our leadership products, with our increased full-year guidance reflecting higher AMD organic growth and the addition of the growing Xilinx business.”

Q1 2022 Results

- Revenue of $5.9 billion was up 71% year-over-year and 22% quarter-over-quarter driven by higher revenue in the Computing and Graphics and Enterprise, Embedded and Semi-Custom segments and the inclusion of Xilinx revenue.

- Gross margin was 48%, an increase of 2 percentage points year-over-year and a decrease of 2 percentage points quarter-over-quarter. The year-over-year increase was primarily driven by higher server processor revenue and high margin Xilinx revenue, partially offset by amortization of intangible assets and acquisition-related costs. The quarter-over-quarter decrease was primarily due to amortization of intangible assets and acquisition-related costs.

- Non-GAAP gross margin was 53%, an increase of 7 percentage points year-over-year and 3 percentage points quarter-over-quarter. The year-over-year increase was primarily driven by higher server processor revenue and high margin Xilinx revenue. The quarter-over-quarter increase was primarily driven by high margin Xilinx revenue, higher server processor revenue and richer client product mix.

- Operating income was $951 million compared to $662 million a year ago and $1.2 billion in the prior quarter. The year-over-year increase was primarily driven by higher revenue and gross profit, partially offset by amortization of intangible assets and acquisition-related costs. The quarter-over-quarter decrease was primarily due to amortization of intangible assets and acquisition-related costs.

- Record non-GAAP operating income was $1.8 billion compared to $762 million a year ago and $1.3 billion in the prior quarter. The year-over-year and quarter-over-quarter increases were primarily driven by higher gross profit.

- Net income was $786 million compared to $555 million a year ago and $974 million in the prior quarter. The year-over-year increase was primarily driven by higher operating income. The quarter-over-quarter decrease was primarily due to lower operating income related to amortization of intangible assets and acquisition-related costs.

- Record non-GAAP net income was $1.6 billion compared to $642 million a year ago and $1.1 billion in the prior quarter. The year-over-year and quarter-over-quarter increases were primarily driven by higher operating income.

- Diluted earnings per share was $0.56 compared to $0.45 a year ago and $0.80 in the prior quarter. Record non-GAAP diluted earnings per share was $1.13 compared to $0.52 a year ago and $0.92 in the prior quarter.

- Cash, cash equivalents and short-term investments were $6.5 billion at the end of the quarter. The company repurchased $1.9 billion of common stock during the quarter.

- Record cash from operations was $995 million in the quarter compared to $898 million a year ago and $822 million in the prior quarter. Record free cash flow was $924 million in the quarter compared to $832 million a year ago and $736 million in the prior quarter.

- AMD’s balance sheet reflects $49.6 billion of goodwill and acquisition-related intangible assets associated with the acquisition of Xilinx.

Quarterly Financial Segment Summary

- Record Computing and Graphics segment revenue was $2.8 billion, up 33% year-over-year and 8% quarter-over-quarter. The year-over-year increase was driven by Ryzen™ and Radeon™ processor sales. The quarter-over-quarter increase was driven by Ryzen™ processor sales.

- Client processor average selling price (ASP) increased year-over-year and quarter-over-quarter driven by a richer mix of Ryzen processor sales.

- GPU ASP increased year-over-year driven by high end Radeon processor sales and decreased quarter-over-quarter due to a lower mix of data center GPU revenue.

- Record operating income was $723 million compared to $485 million a year ago and $566 million in the prior quarter. Operating income improvements were primarily driven by higher revenue, partially offset by higher operating expenses.

- Record Enterprise, Embedded and Semi-Custom segment revenue was $2.5 billion, up 88% year-over-year and 13% quarter-over-quarter driven by higher EPYC™ processor revenue, semi-custom and embedded product sales.

- Record operating income was $881 million compared to $277 million a year ago and $762 million in the prior quarter. Operating income improvements were primarily driven by higher revenue and an $83 million licensing gain.

- Xilinx partial quarter revenue was $559 million with operating income of $233 million. On a pro-forma basis for the full quarter, Xilinx generated over $1 billion of revenue, up 22% year-over-year, driven by growth across all Xilinx major end market categories.

- All Other operating loss was $886 million as compared to operating losses of $100 million a year ago and $121 million in the prior quarter. Higher operating loss was primarily due to amortization of intangible assets and acquisition-related costs.