Bitcoin charted its lowest price level since Russia invaded Ukraine below $36,000. Some altcoins suffered even more.

After failing at $40,000 two days ago, bitcoin was violently rejected and dumped by over $4,000 in hours to its lowest price point in over two months. The alternative coins are also buried in red, with massive price drops from Solana, Polkadot, Avalanche, and many others.

Bitcoin Slumped Below $36K

It was just a few days ago when the primary cryptocurrency started its recovery from its most recent sub-$38,000 price dip. The bulls pushed the asset north following the FOMC meeting, in which the Fed said it will raise interest rates by 50 basis points instead of 75, and BTC tapped $40,000.

However, this leg up was short-lived as bitcoin was stopped there and remained at just under that level for the next day.

The situation changed vigorously in the following several hours, as reported yesterday. Bitcoin started crashing hard and dumped by approximately $4,000. Aside from causing millions of dollars in liquidations, the cryptocurrency plunged to its lowest level since Russia invaded Ukraine, below $36,000.

As of now, BTC has reclaimed some ground and sits above that level, but it’s still 8% down on the day. As a result, its market capitalization has plummeted below $700 billion.

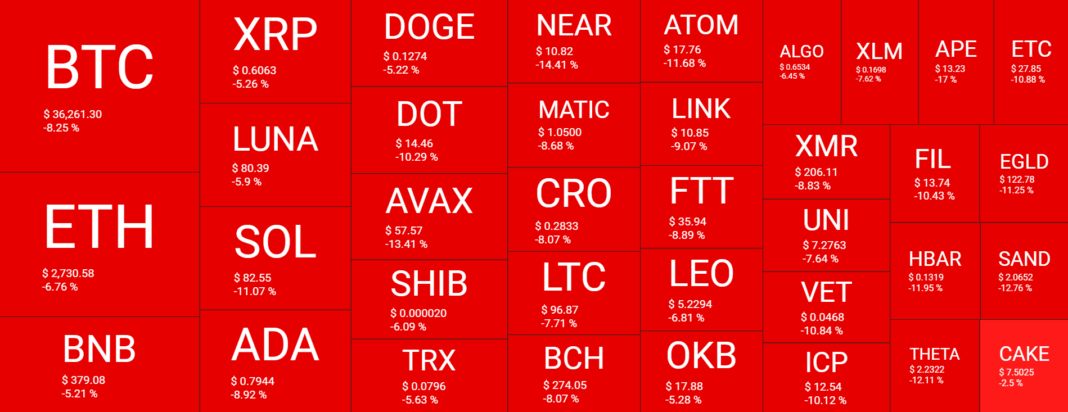

Altcoins See Only Red

As it typically happens when BTC dumps hard, so do the alternative coins. Ethereum is a prime example, as it stood above $2,900 yesterday. Now, though, a 7% daily drop has pushed the second-largest cryptocurrency by around $200 down. Moreover, ETH even dipped beneath $2,700 hours ago.

BNB, Ripple, Terra, Dogecoin, Shiba Inu, and Tron have all lost between 5-6% in the past 24 hours. Even more price drops are evident from Solana (-11%), Cardano (-9%), Polkadot (-10%), Avalanche (-13%), and NEAR Protocol (-15%).

The lower- and mid-cap alts are in an even worse situation. STEPN (-26%), Zilliqa (-20%), ApeCoin (-17%), Waves (-17%), Moonbeam (-17%), Axie Infinity (-16%), Kava (-15%), and Fantom (-15%) have all lost double-digits.

Ultimately, the cumulative market cap of all crypto assets saw $150 billion gone and is down way below $1.7 trillion.

Source: cryptopotato.com