Large chip companies said they expected limited supply chain disruption for now from the Russia-Ukraine conflict, thanks to raw material stockpiling and diversified procurement, but some industry sources said there could be an impact longer term.

Europe faced one of its biggest security crises in decades, after Russia invaded Ukraine by land, air and sea.

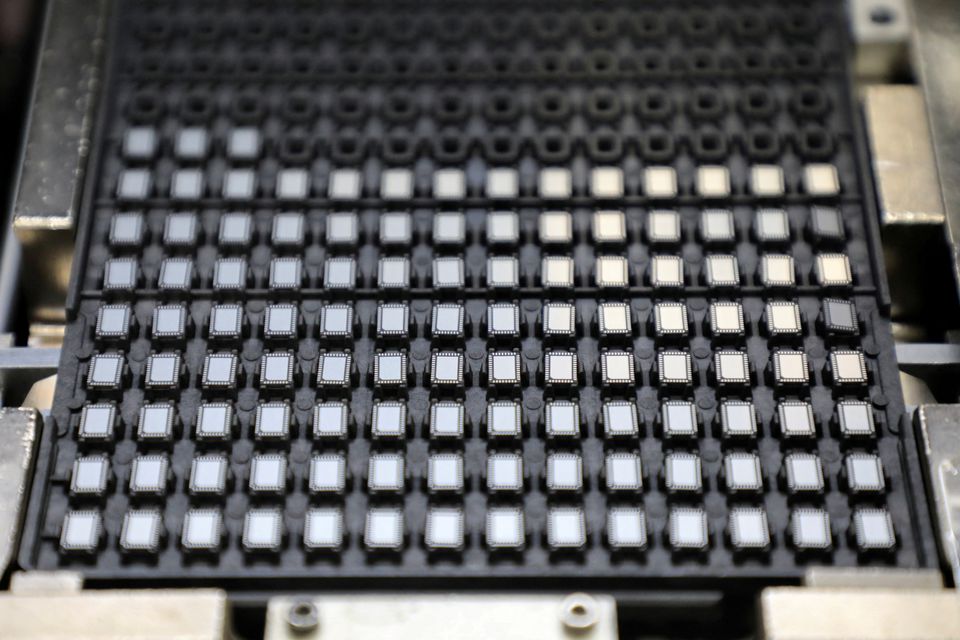

The crisis hit stocks of tech companies that source or sell globally amid fears of further supply chain disruptions after a yearlong shortage of semiconductor chips.

Ukraine supplies more than 90% of U.S. semiconductor-grade neon, critical for lasers used in chipmaking. The gas, a biproduct of Russian steel manufacturing, is purified in Ukraine, market research firm Techcet says. Russia is the source of 35% of the palladium used in the United States. The metal is used in sensors and memory, among other applications.

“The chipmakers are not feeling any direct impact, but the companies that supply them with materials for semiconductor fabrication buy gases, including neon and palladium, from Russia and Ukraine,” said a Japanese chip industry source who spoke on condition of anonymity. “The availability of those materials is already tight, so any further pressure on supplies could push up prices. That in turn could knock on to higher chip prices.”

But companies are better prepared than in recent years, thanks to other disruptions and conflicts.

“We understand that reports of potential disruption of supply of minerals and noble gases, due to ongoing tensions between Russia and Ukraine, are concerning for the semiconductor industry,” memory chip maker Micron Technology said, but added that it had “diversified sourcing” for its supplies.

The White House told the chip industry to diversify its suppliers in case Russia retaliated against U.S. sanctions, which have so far targetted Russia’s Nord Stream 2 gas pipeline to Europe and some Russian banks. Further steps are expected.

Source: Reuters.com