Key Insights from LendingClub’s and PYMNTS’ 6th Paycheck-To-Paycheck Report

LendingClub Corporation (NYSE: LC), the parent company of LendingClub Bank, America’s leading digital marketplace bank, today released findings from its sixth edition of the Reality Check: Paycheck-To-Paycheck research series, conducted in partnership with PYMNTS.com.

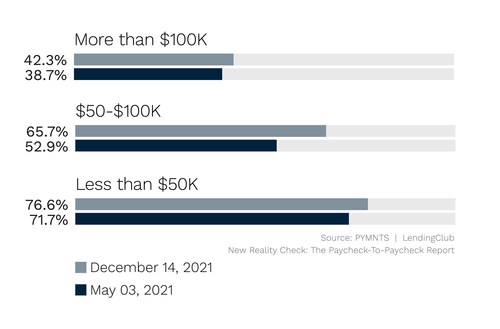

Key takeaway: At the end of 2021, 61 percent of the U.S. population lived paycheck to paycheck, up seven percentage points since the first report in June 2021. Forty-two percent of U.S. consumers earning more than $100,000 annually now live paycheck to paycheck as well, up three percentage points from May 2021.

Consumers who live paycheck to paycheck are in all income brackets

The share of consumers living paycheck to paycheck remains below a high of 65% seen in December 2020. That figure was 54% in May 2021 and has been rising since then, hitting 61% in December 2021.

Seventy-seven percent of consumers who reported earning less than $50,000 per year lived paycheck to paycheck in December 2021, up slightly from 72% in May 2021. Meanwhile, 66% of those who reported earning between $50,000 and $100,000 now live paycheck to paycheck — a notable rise from 53% in May 2021.

More affluent consumers also reported living paycheck to paycheck. Among consumers who reported earning more than $100,000, 42% were living paycheck to paycheck in December 2021, up from 39% in May 2021.

“With more than 3 in 5 Americans now living paycheck to paycheck, this reality is impacting every income bracket across every generation – a trend which we’ve only seen increase since May 2021,” said Anuj Nayar, Financial Health Officer at LendingClub. “Now more than ever, consumers need an ally. That is why at LendingClub we’re striving to build a digital marketplace bank that puts the customers’ needs at the center of everything we do.”

Consumers who live paycheck to paycheck hail from all generations

The report takes a deep dive into the generational demographics of consumers currently living paycheck to paycheck. The findings indicate that millennials are the most likely to live paycheck to paycheck, but the greatest increase in the share of consumers living paycheck to paycheck is seen among baby boomers and seniors. In December 2021, 54% of baby boomers and seniors were living paycheck to paycheck, a 14-percentage point increase from 40% in May 2021.

Research shows that 70% of both bridge millennials and millennials were living paycheck to paycheck in December 2021. Sixty-five percent of Generation Z consumers reported living paycheck to paycheck in December 2021, up from 55% in May 2021. Sixty percent of Generation X consumers were also living paycheck to paycheck in December 2021, with 56% doing so in May.

Savings levels are a key differentiator between those who live paycheck to paycheck and struggle to pay bills and those who do not

Paycheck-to-paycheck consumers fall into two categories: those who are and those who are not able to pay their bills easily. The data reports a striking gap in savings between consumers living paycheck to paycheck who struggle to pay their bills and those who live paycheck to paycheck but do not struggle with their bills. The difference is even more stark among consumers who do not live paycheck to paycheck and those who do and have trouble paying their monthly bills. This chasm widens even further among older age groups.

Generation Z consumers who live paycheck to paycheck and have issues paying their monthly bills report the lowest average savings at just $1,158. Millennials living paycheck to paycheck with issues paying their monthly bills report the highest savings, with an average of $3,731. Savings amounts decrease and then level off as consumers get older.

The research finds that paying for an emergency expense can be a significant challenge for all consumers living paycheck to paycheck, especially for those who struggle to pay their bills each month. At 59%, Generation Z consumers who live paycheck to paycheck and have issues paying their bills are the most likely to be unable to afford a $400 emergency expense. This is followed by Generation X consumers who live paycheck to paycheck and struggle to pay their bills at 51%. Forty-six percent of bridge millennials, 44% of millennials, and 42% of baby boomers and seniors who live paycheck to paycheck also report the same.

To view the full report, visit: https://www.pymnts.com/study/reality-check-paycheck-to-paycheck-consumer-planning-financial-emergency/

Methodology

The New Reality Check: The Paycheck-To-Paycheck Report is based on a census-balanced survey of 3,070 U.S. consumers conducted from Dec. 2, 2021, to Dec. 14, 2021, as well as an analysis of other economic data.