Record quarterly revenue of $4.8B up 49% y/y; Record full year revenue of $16.4B up 68%; Gross margin expanded and operating income more than doubled from prior year

AMD (NASDAQ:AMD) announced revenue for the fourth quarter of 2021 of $4.8 billion, operating income of $1.2 billion, net income of $974 million and diluted earnings per share of $0.80. On a non-GAAP() basis, operating income was $1.3 billion, net income was $1.1 billion and diluted earnings per share was $0.92. For full year 2021, the company reported revenue of $16.4 billion, operating income of $3.6 billion, net income of $3.2 billion and diluted earnings per share of $2.57. On a non-GAAP() basis, operating income was $4.1 billion, net income was $3.4 billion and diluted earnings per share was $2.79.

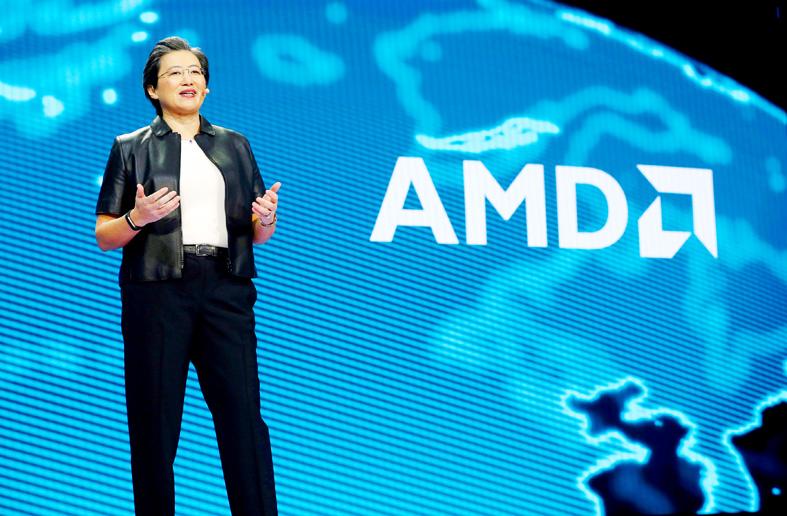

“2021 was an outstanding year for AMD with record annual revenue and profitability,” said AMD President and CEO Dr. Lisa Su. “Each of our businesses performed extremely well, with data center revenue doubling year-over-year driven by growing adoption of AMD EPYC processors across cloud and enterprise customers. We expect another year of significant growth in 2022 as we ramp our current portfolio and launch our next generation of PC, gaming and data center products.”

Q4 2021 Results

• Revenue of $4.8 billion was up 49 percent year-over-year and 12 percent quarter-over-quarter driven by higher revenue in the Computing and Graphics and Enterprise, Embedded and Semi-Custom segments.

• Gross margin was 50 percent, an increase of more than 5 percentage points year-over-year and approximately 2 percentage points quarter-over-quarter. The year-over-year and quarter-over-quarter increases were primarily driven by a richer product mix.

• Operating income was $1.2 billion compared to $570 million a year ago and $948 million in the prior quarter. Non-GAAP operating income was $1.3 billion compared to $663 million a year ago and $1.1 billion in the prior quarter. Operating income improvements were primarily driven by higher revenue and gross margin expansion.

• Net income was $974 million compared to $1.8 billion a year ago, which included a $1.3 billion income tax benefit associated with a valuation allowance release, and $923 million in the prior 3 quarter. Non-GAAP net income was $1.1 billion compared to $636 million a year ago and $893 million in the prior quarter.

• Diluted earnings per share was $0.80 compared to $1.45 a year ago, which included a $1.06 per share income tax benefit, and $0.75 in the prior quarter. Non-GAAP diluted earnings per share was $0.92 compared to $0.52 a year ago and $0.73 in the prior quarter.

• Cash, cash equivalents and short-term investments were $3.6 billion at the end of the quarter. The company repurchased $756 million of common stock during the quarter.

• Cash from operations was $822 million in the quarter compared to $554 million a year ago and $849 million in the prior quarter. Free cash flow was $736 million in the quarter compared to $480 million a year ago and $764 million in the prior quarter. Fourth quarter cash from operations and free cash flow included strategic investments in long-term supply chain capacity to support future revenue growth.