The cryptocurrency market capitalization added more than $150 billion in a day as bitcoin and ether went on a roll following Fed news.

Bitcoin fell below $47,000 once more in the past 24 hours, but the Fed’s rates announcement sent it north by more than $3,000. The altcoins also registered impressive price increases as Ethereum reclaimed the $4,000 level.

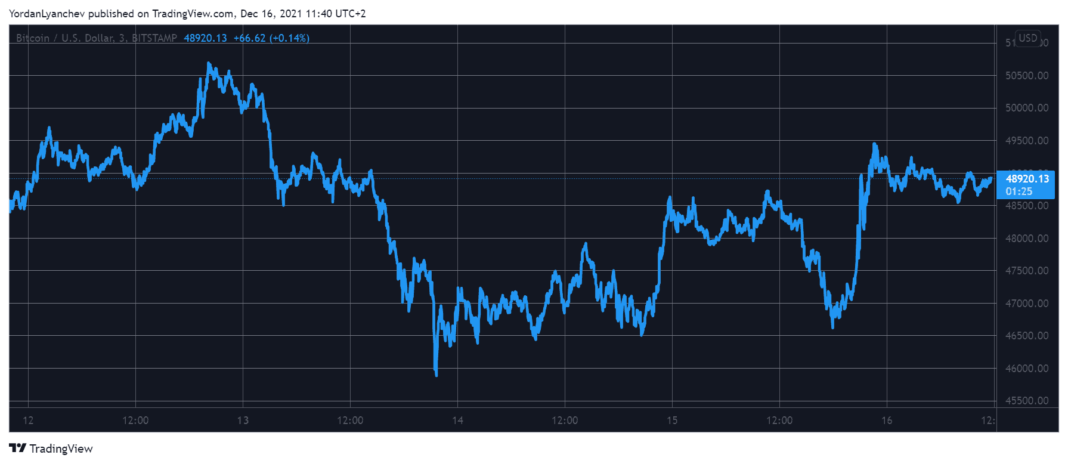

Bitcoin Neared $50K on US Fed News

CryptoPotato reported yesterday that bitcoin’s situation had worsened after the asset failed to overcome $49,000. It continued to drop in the following hours and slipped below $47,000 for the second time in three days.

All eyes were on the FOMC meeting in the US as the Federal Reserve was expected to make an announcement in regards to its monetary policy and, perhaps most importantly, its plans on how to tackle the increasing inflation.

The central bank said it will not change the interest rates, which caused an immediate reaction for the primary cryptocurrency and other financial markets. BTC spiked by nearly $4,000 and neared $50,000 but couldn’t surpass it as with most previous attempts.

As of now, the asset has retraced by several hundred dollars, and it stands just shy of $49,000.

ETH Above $4K: AVAX Spikes 12%

The altcoins suffered as well lately, but the Fed news had a positive impact on most. Ethereum had dropped below $3,800 just a few days ago, but a 4% daily increase has driven it above $4,000 as of now.

Binance Coin, Ripple, Cardano, and Polkadot are all slightly in the green on a 24-hour scale. Solana (8%) and Terra (7%) have added more value, while Avalanche (12.5%) has outperformed all other larger-cap alts. Consequently, AVAX now sits above $100 just days after announcing support for USDC.

The two largest memecoins – Dogecoin and Shiba Inu – are slightly in the red.

More gains come from XDC Network (32%), BORA (26%), Arweave (17%), Elrond (15%), Kadena (15%), Stacks (15%), and others.

The cryptocurrency market cap dipped to $2.1 trillion yesterday, but it’s up by more than $150 billion since then to $2.250 trillion.