Hope you are all doing well and had a great week. At the time of writing, BTC sits at $50,312 after hitting a weekly high of $59,592 on Monday and low of $46,000 on Wednesday. Previous letters described a bullish setup, which still holds true based on fundamental investor activity. However, Wednesday’s events may have put a damper on how immediate the end of this consolidation may come. We have a lot to discuss so let’s get straight into it.

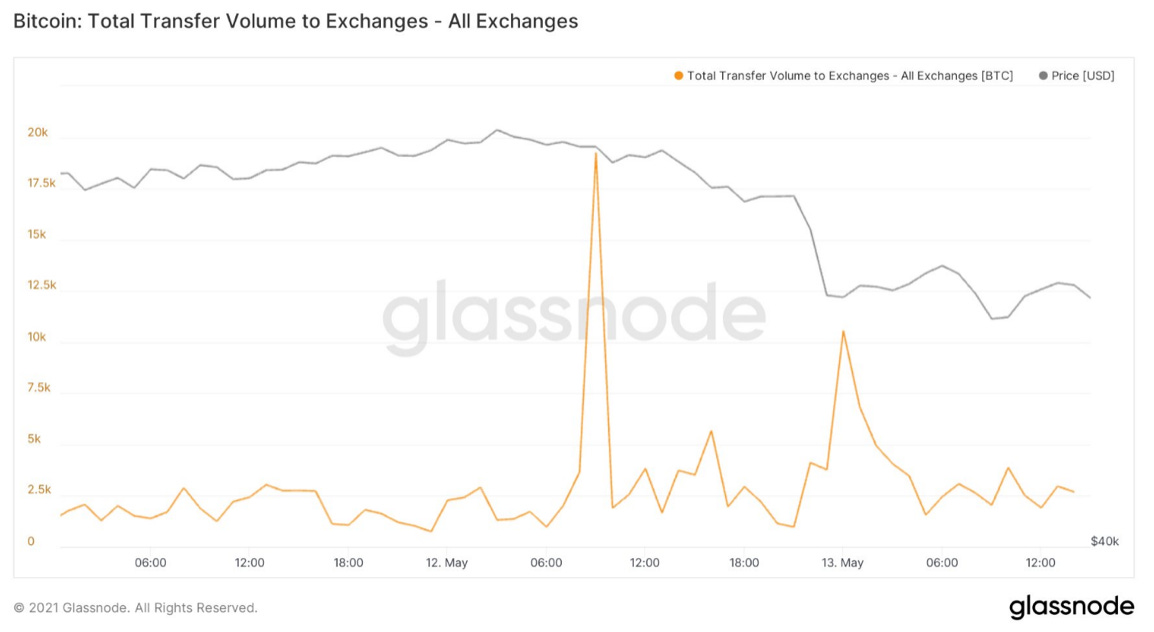

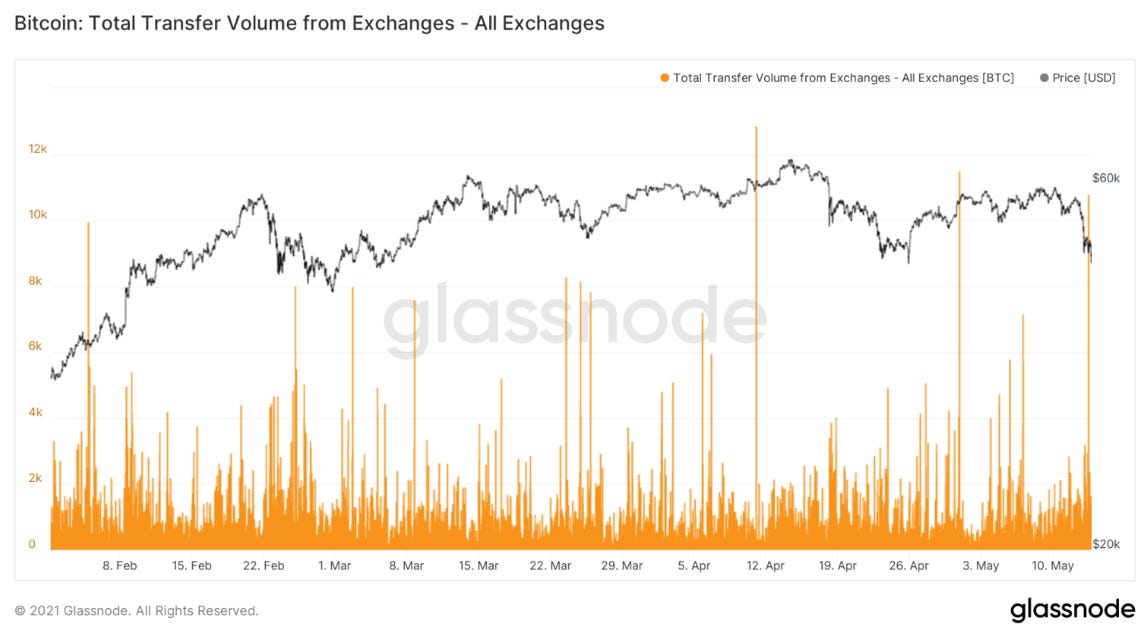

Let us first cover the elephant in the room: the Elon dump. Firstly, there were 19,259 BTC moved onto exchanges before Elon’s tweet and ensuing price dump. I do not think this is coincidence and was likely someone with insider information.

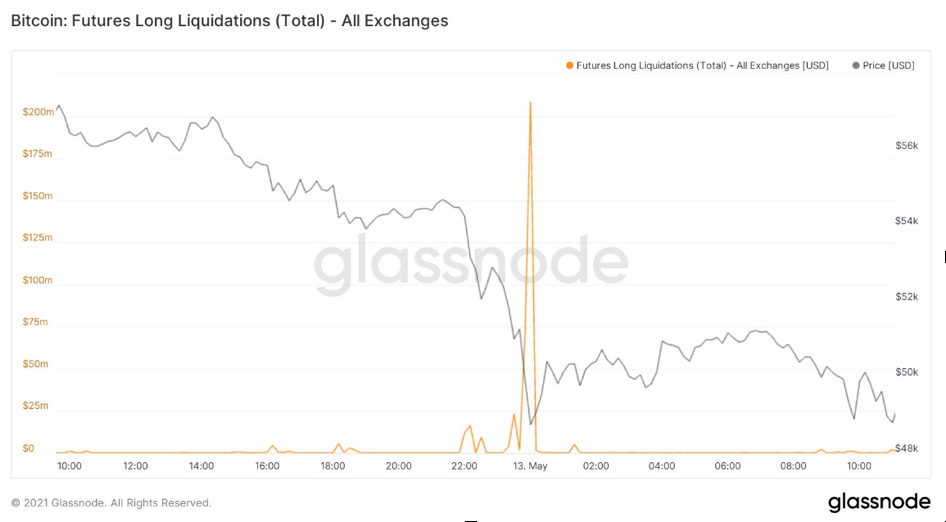

Elon’s tweet regarding the energy use of Bitcoin at 6:06PM EST initiated a cascade of long liquidations, including $208M within a 10-minute period. This cascade of liquidations is why the price dump down to $46,000 was so aggressive.

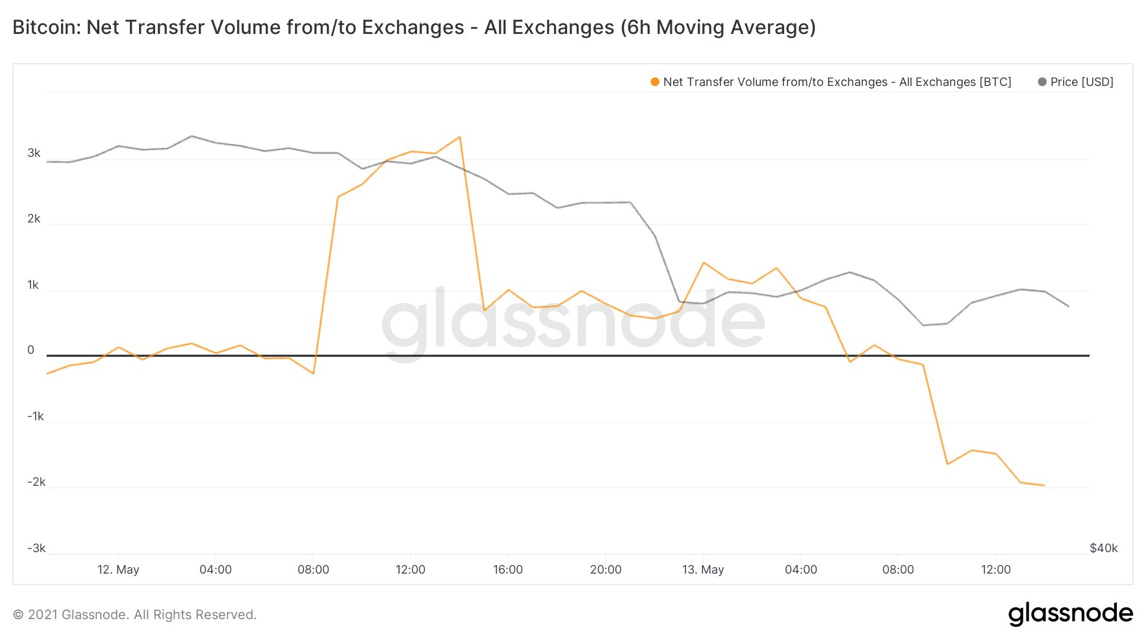

It’s very interesting to see inflows to exchanges (presumed selling) spike in the time before the tweet, followed by net outflows ramping up after the event. This data makes a strong case for someone having insider information. Would be quite a coincidence to say the least.

Speaking of exchange flows, one of the largest exchange outflows of the year took place amidst all the panic. OTC outflows also spiked during the dip; it appears big money bought the fear.

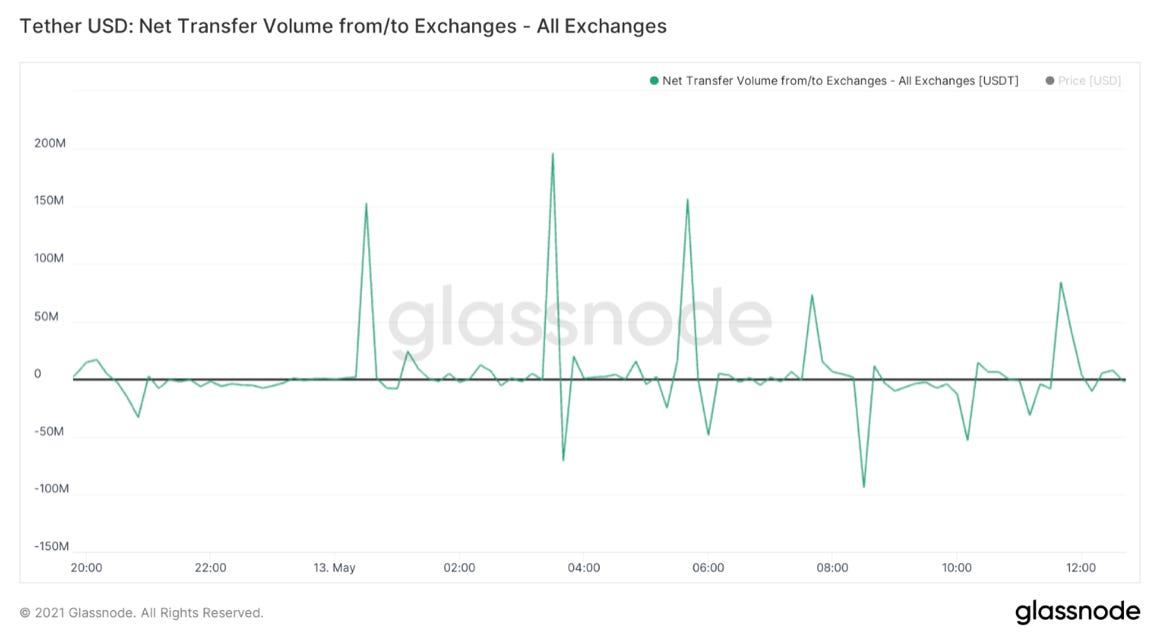

Roughly $460,000,000 of Tether was printed following the sell off. In the chart below showing net transfer volume, over $650,000,000 of Tether was moved onto exchanges Thursday. Tether does not always signal instant buys, but capital is on exchanges waiting to be deployed.

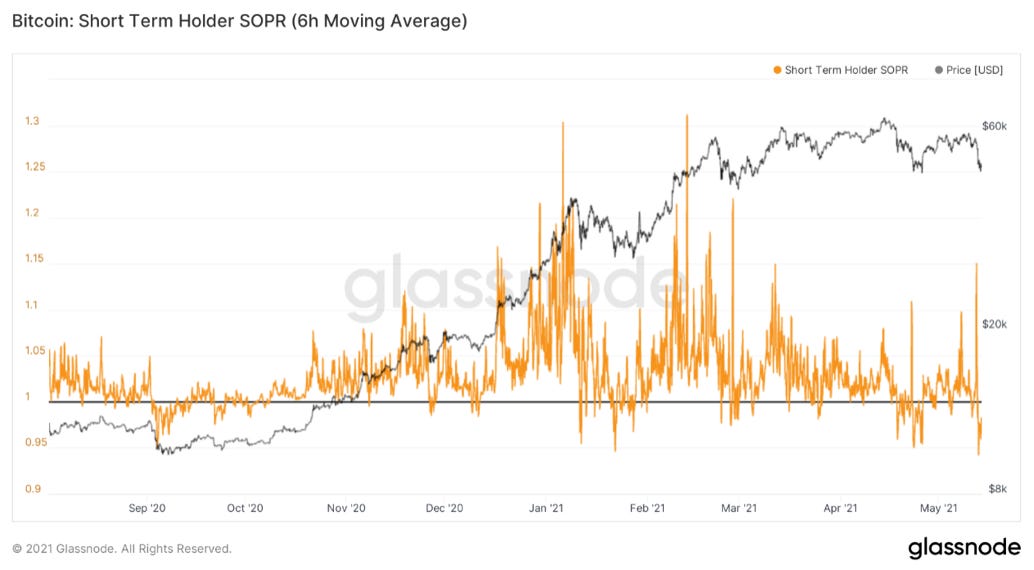

Short term holder SOPR reset to the lowest it has been this entire bull run. This means the market was taking losses on aggregate. This metric has timed each major bottom throughout the bull run. This metric along with funding rates going negative signals to me that we are very close to the bottom, if we have not reached one already.

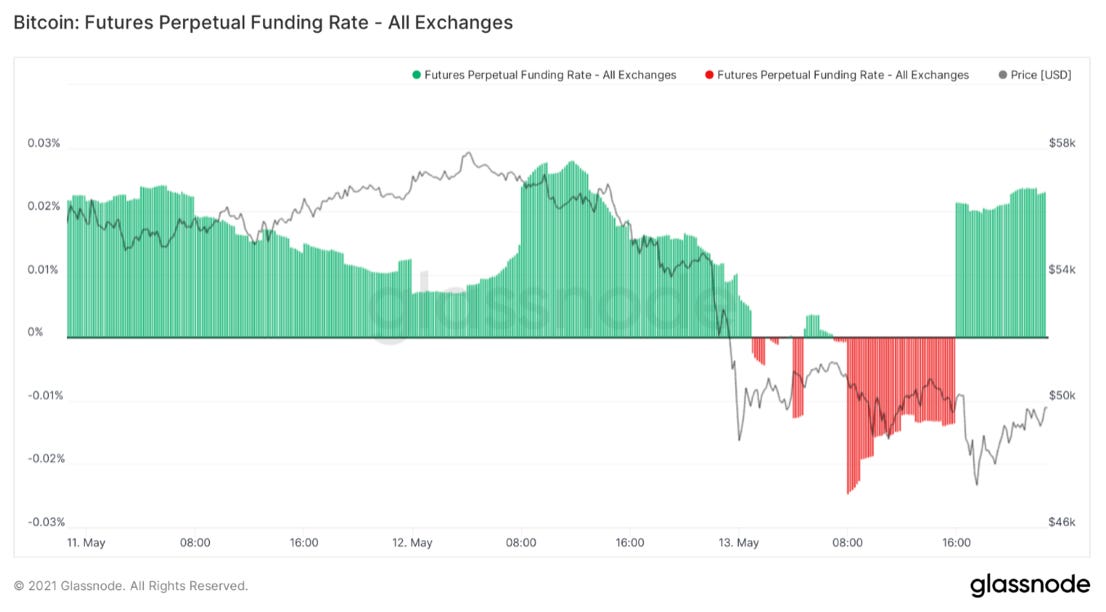

As just mentioned, funding rates went negative Wednesday night for the first time in almost a month. This means traders were seeking to go short on aggregate and shorts began funding longs. Funding rates are a good way to gage sentiment of traders. Negative funding rates show they were scared to go long on aggregate. However, funding rates came back rather quickly, unlike anything I have seen in previous corrections.

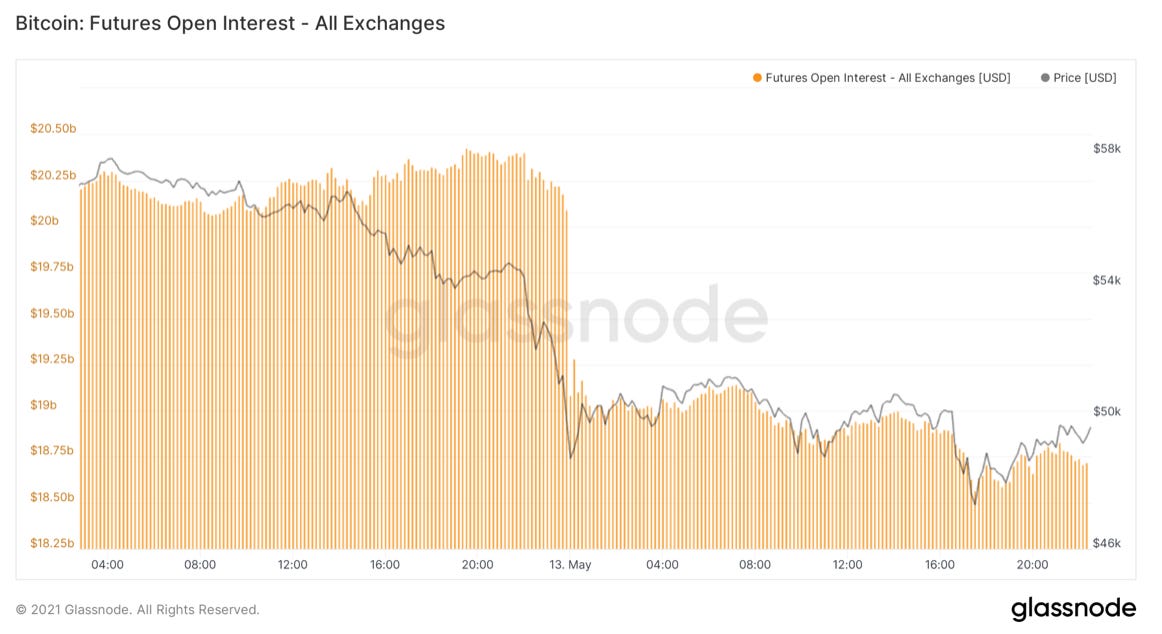

Some silver lining of the event is that leveraged traders getting wiped out. Roughly $1.8B of futures open interest was wiped out. This is always healthy for the market as price is then more influenced by organic spot buying and not speculation.

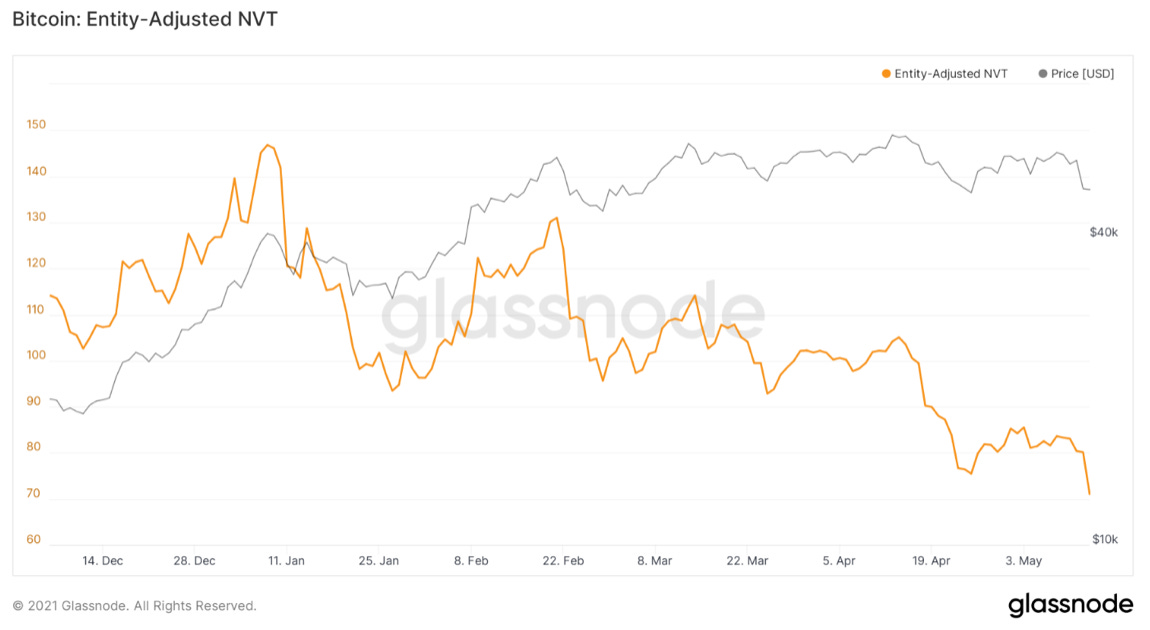

Despite the short-term price action, this still does not change broader on-chain trends for this cycle. One that we have not discussed yet in previous letters is NVT. NVT is a ratio of market cap to on-chain transactional volume. When market cap is growing faster than underlying investor activity, NVT goes up. When market cap growth is not keeping up with underlying investor activity, NVT goes down. Since January, NVT has steadily trended down. This means that this bull run is becoming less overheated as underlying investor activity continues to outpace market cap. This also is a sign of consolidation.

The number of whales (entities with balances over 1,000 BTC) is still trending down. This is not abnormal or anything to be concerned about, as whales usually begin to scale out of their positions mid-way through the bull run. In fact, in 2017 the growth of whales peaked around $675, which of course was far from the top.

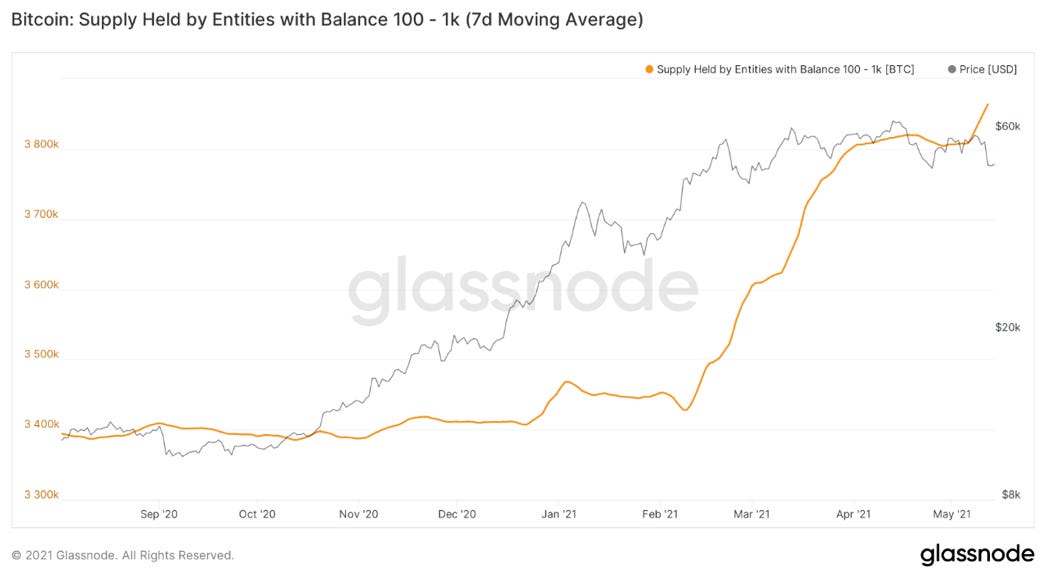

Despite the sell off from the whale cohort, entities with 100-1,000 BTC continues to trend upward, actually offsetting the decrease in the 1k-10k cohort by 86,160 BTC.

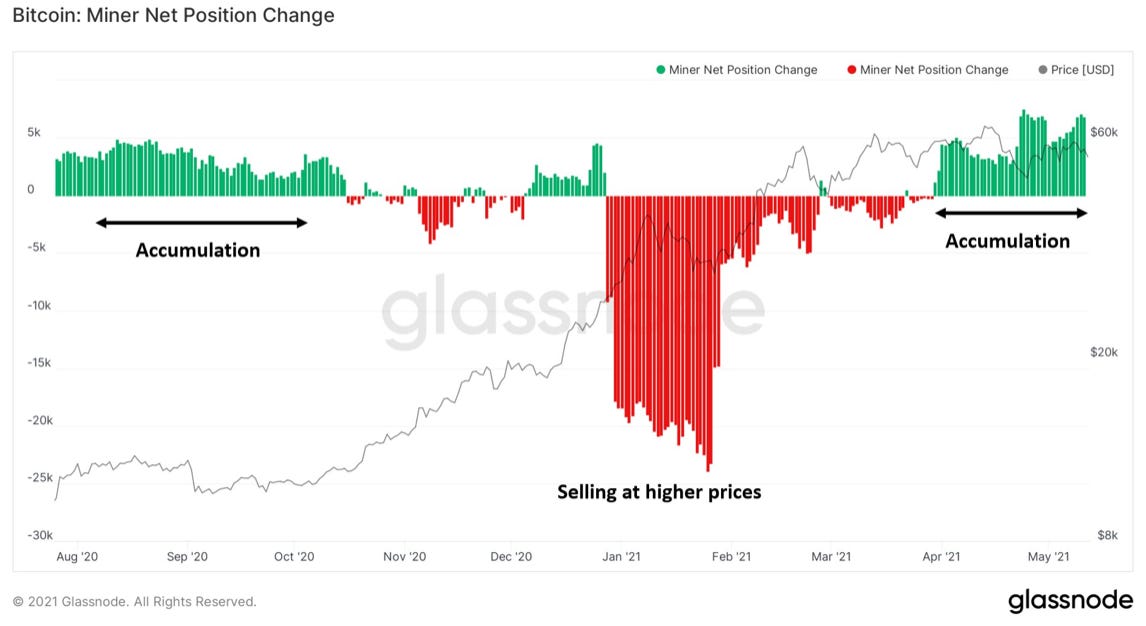

Miners still do not seem phased by short term price action and continue to accumulate as they have throughout this entire consolidation. This can be illustrated by two metrics: the first of which is miner net position change. This measures the trailing 30-day average of miner balance movements. This metric has been in the green for well over a month now.

Miner unspent supply is also still trending up and saw a spike during the sell off.

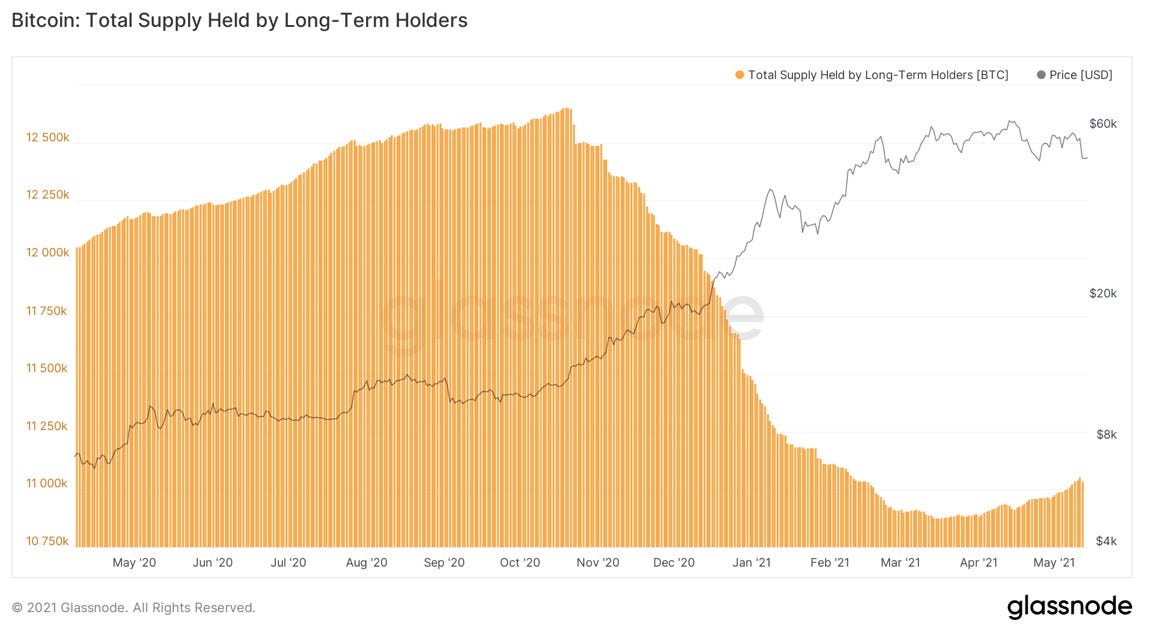

Supply held by long-term holders seems to be ticking back up after bottoming out in late March/early April. This sign of re-accumulation is good to see after this cohort trimmed their holdings throughout October to March.

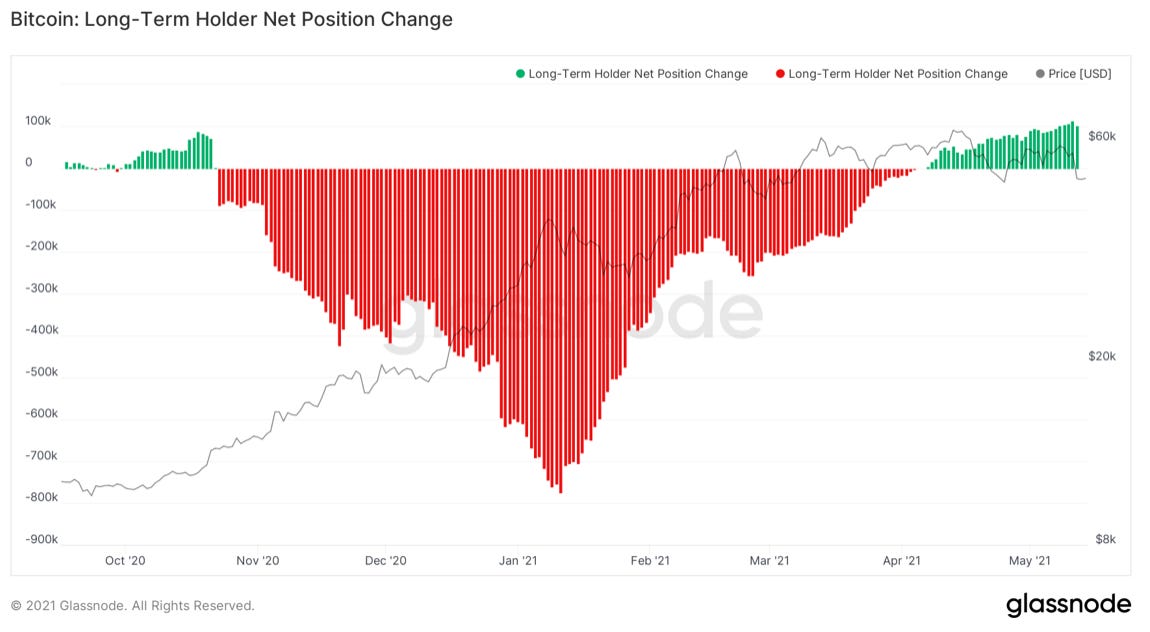

Long-term net position change illustrates a similar picture, with these entities selling off after all time highs, but now steadily accumulating throughout this consolidation for over a month now.

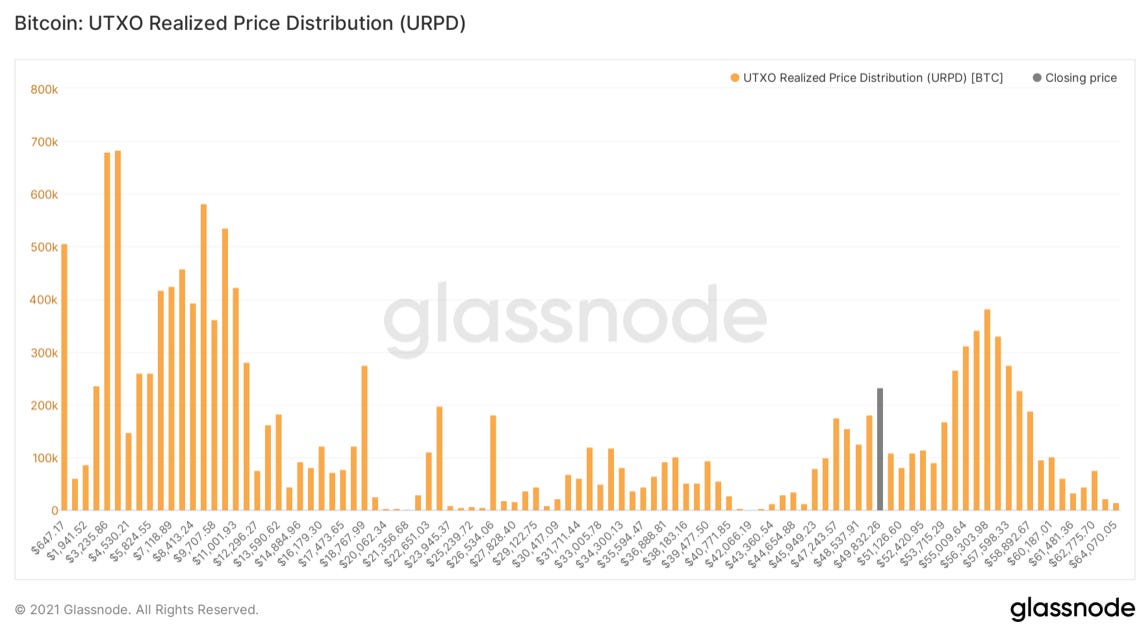

In conclusion, Wednesday’s event was unfortunate for short term price action, but changes nothing in the longer-term bull structure. This does not change the fact that on-chain shows BTC is still consolidating. We continue to build up a large zone of on-chain volume at these levels, shown by URPD. I remain bullish for the coming weeks.